Deepening trade ties between India and Gulf Cooperation Council ( GCC ) countries are opening more cross-investment opportunities, with a focus on energy and logistics, while reducing the potential impact of tariffs from the United States.

In 2024, India invested 52.3 billion dirhams ( US$14.2 billion ) in Dubai, data from fDi Markets show, making Asia’s fastest-growing major economy the largest foreign investor in the Arab emirate.

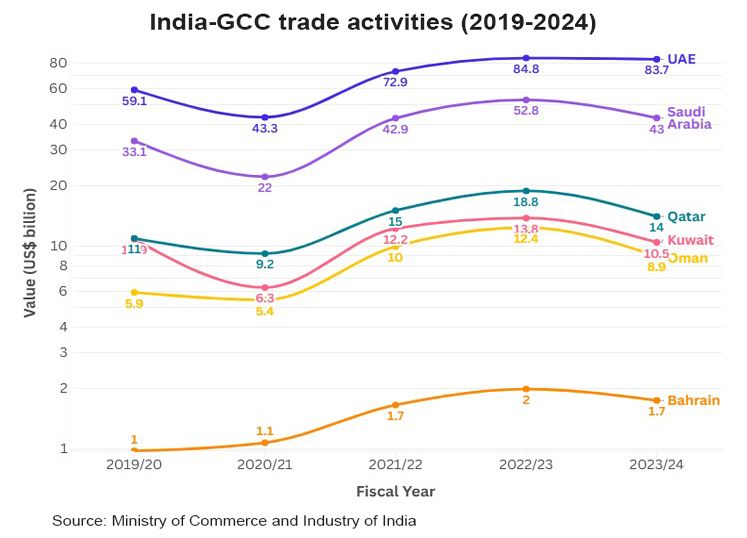

Since 2000, India has pumped US$15.3 billion into the United Arab Emirates, or 5% of the country’s total overseas direct investments, while the UAE has invested US$19 billion in India, according to official data from India. Over the five-year period to 2024, bilateral trade rose more than 40% to US$83.7 billion.

India and Saudi Arabia are also in talks to enhance bilateral trade. Last October, the two countries signed actionable agreements to increase trade volumes and reduce friction in investment flows, particularly in trade, energy and technology. Bilateral trade peaked at US$52.8 billion in 2023 and moderated to US$43 billion last year, which is still up 30% from 2019.

Meanwhile, Qatar and India have agreed to double bilateral trade from the current level of US$14 billion in the next five years. During the visit of Qatar's Emir Sheikh Tamim bin Hamad Al-Thani to India in February, the two sides signed memorandums of understanding covering trade, investment and energy cooperation, with the Qatar Investment Authority committing to investing US$10 billion in India’s high-growth sectors.

Bolstering regional partnerships can help India soften the impact of tariffs announced by US President Donald Trump even as trade talks between New Delhi and Washington continue. The Centre for Public Policy Research ( CPPR ) suggests that India further cultivate its relationships with GCC countries to address tariff risks and other issues related to its trade relations with the US and European markets.

Energy collaboration

Energy cooperation is an important part of trade and investment ties between India and the GCC. Qatar, the primary exporter of liquefied natural gas to India, has signed a contract to supply 7.5 million tonnes of LNG to the Asian country annually until 2044.

Saudi Arabia and the UAE, both longstanding energy security providers to India, are exploring opportunities in alternative energy, including cooperation in the use of nuclear power in health, agriculture and science.

Although petroleum and crude oil still form the bulk of energy cooperation between Saudi Arabia and India, both countries are also exploring ways to advance the agenda for renewables. Last October, they signed a memorandum of understanding to pursue collaboration in green hydrogen.

India, meanwhile, has offered to supply special steel for Saudi Arabia’s US$1.5 trillion NEOM mega city project, making the Asian country a prime supporter of the kingdom’s renewable energy push.

“The GCC remains a key energy supplier to India, with increased collaboration in the oil and gas sectors alongside a significant push towards renewable energy projects, reflecting a mutual commitment to sustainability and green technology,” the CPPR says.

Warehousing opportunities

The real estate sector is playing an increasingly significant role in relations between India and the GCC countries. Warehousing is of particular interest to foreign investors amid the rapid development of e-commerce, which is facilitated by optimized supply chains and advanced technology.

Private equity investment in India’s warehousing segment surged 136% year-on-year to US$187.7 billion in 2024, according to a Knight Frank report. Middle Eastern investors, dominated by those from the UAE, contributed 42% to the total investment last year. UAE-based Sharaf Group, for example, has announced plans to invest 50 billion rupees ( US$580 million ) in the logistics and shipping industries of Kerala, a coastal state in India striving for logistics expansion. underscoring the support from UAE into India’s warehouse development.

The growth of India’s warehouse sector, meanwhile, has spurred the country to explore further export opportunities in top trade hubs, while serving to highlight the country’s supply chain capabilities overseas.

In 2024, the warehouse project Bharat Mart kicked off at the Jebel Ali Free Trade Zone in Dubai, providing Indian companies with access to logistics, retail and hospitality facilities to showcase their products. Some 9,000 expressions of interest have been received for over 1,400 units in the complex, which is expected to be completed in 2026.

Strong backing to start-ups

India’s thriving start-up sector, boasting 140,000 companies as of June 2024, also offers enormous opportunities for cooperation with GCC countries. In March, the India-Saudi Arabia Start-up Bridge was launched to conduct knowledge exchange and facilitate market access between start-ups from both countries.

“The convergence of India’s high-growth start-up ecosystem and Saudi Arabia’s emerging entrepreneurial landscape offers a strategic partnership from which both nations stand to benefit,” says Grant Thornton in an analysis.

“India’s expertise in scaling start-ups globally, particularly in technology, IT services, and digital payments, complements Saudi Arabia’s vision for technological leadership and economic diversification. The increasing emphasis on sectors like artificial intelligence, fintech, and green energy in both countries aligns their start-up trajectories towards cooperation."