Global infrastructure expenditure will have to increase by two-thirds in the next 25 years until 2050 to fuel the world’s economic development, highlighting the need for private funds to close the financing gap, according to a new report.

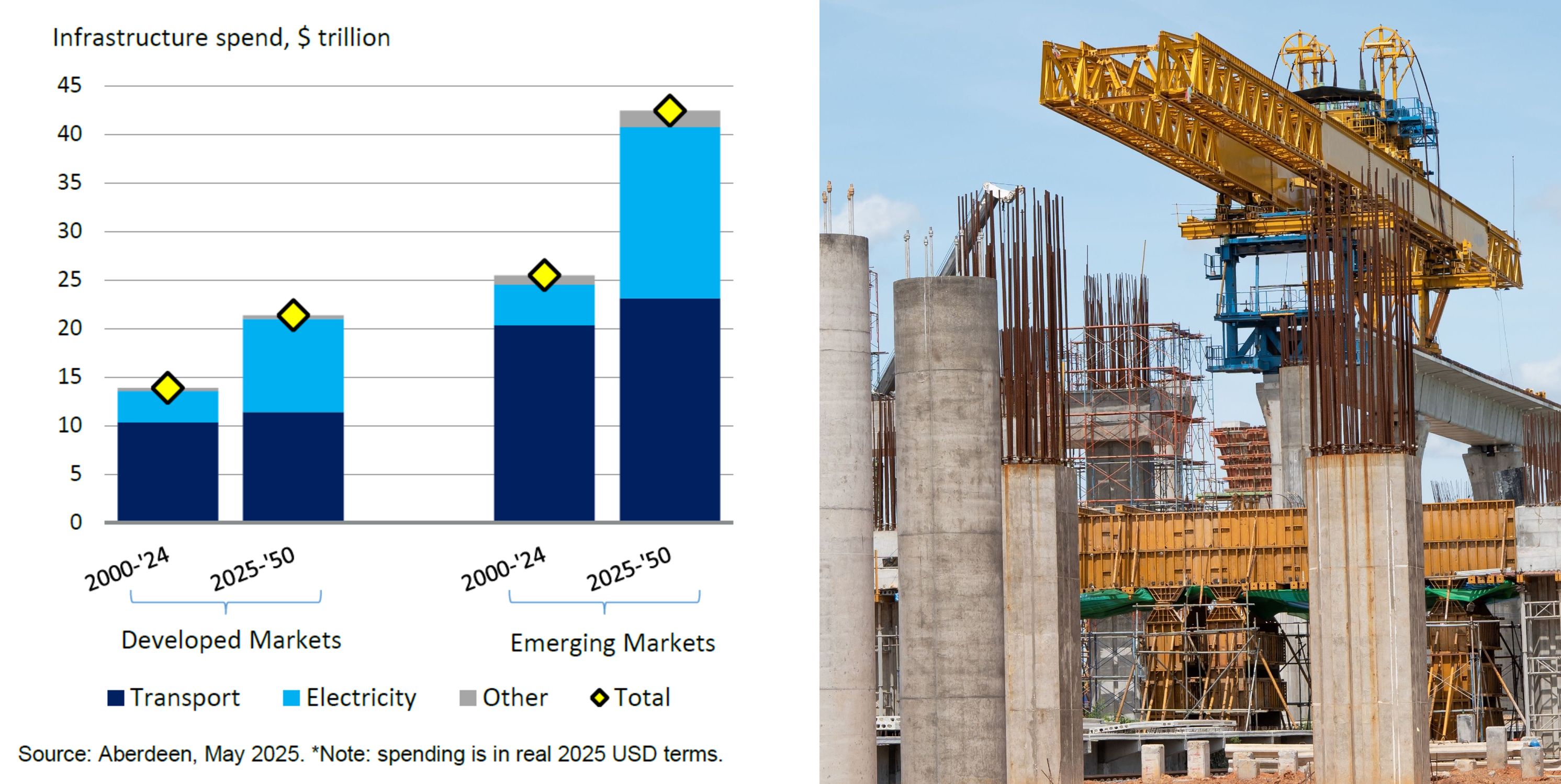

Worldwide physical infrastructure will require US$64 trillion of investment, or 1.7% of the global GDP in the next 25 years. That’s 64% more than the US$39 trillion invested in the first quarter of the century, Aberdeen Investments says in the report.

Transport will account for the largest share of infrastructure development. Roads will have to be extended by at least 700 kilometres, and together with road maintenance, will cost US$28 trillion in the next quarter of the century.

Alongside data centres, the rise of electric vehicles and other new technologies will stretch the global power generation capacity by more than 1.6x to 21,000 gigawatts. And as the world shifts away from dirty fuels, renewable energy needs a significant boost in investment to back these technology developments.

Emerging markets as a whole will spend US$43 trillion on infrastructure, more than twice that of their developed counterparts, to fuel economic growth. China will top the list with an outlay of US$12 trillion for power infrastructure, representing a fifth of the world’s total infrastructure spending.

As the need for massive capital inevitably adds to government debt burdens, the report says private capital – pension, insurance, family offices, infrastructure companies, etc. – will have to plug the financing gap for renewables, reliable energy distribution systems, and clean transport.

“We see midmarket infrastructure companies playing a key role in supporting infrastructure development across themes such as renewables, reliable energy distribution, and clean transportation, such as railways,” says Dominic Helmsley, head of economic infrastructure at Aberdeen Investments.

“Private investors can and should have a net positive effect on infrastructure. They can bring efficiency, capital discipline, innovation and – counter to some preconceptions – a long-term view removed from election cycles,” notes Sameer Amin, the firm’s global head of the concession infrastructure. “Now we need clarity from policymakers on how they want to work with private investors such as ourselves.”